10 June 2024

EU sugar market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during February this year. How did the fundamentals develop and what are the expectations after the sowing 2024 has almost finished?

Nordzucker has successfully completed the sugar production across all its factories in the seven European countries. It has been a challenging and long campaign, driven by severe weather conditions. Total sugar production has been almost unchanged year-on-year. However, this time no emergency refining of imported raw cane sugar needed due to sufficient average beet sugar production.

Sowing is now completed for the new season in all our countries. The period of drilling was however less than optimal. Frequent rain, wet soils and frost nights have resulted in delays in almost every country, particularly in the Northern part of Europe resulting in delay by an average of 14 days compared to previous years.

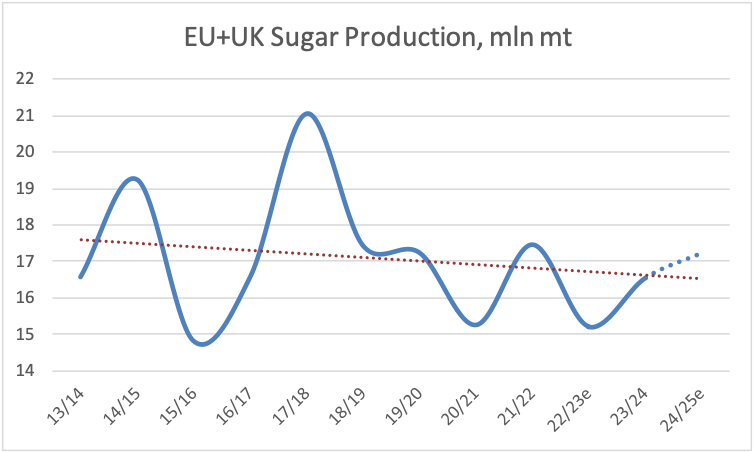

The last seeds were finally put in the ground early May and even if it is still early days, a negative impact on yield can be expected because of the delays. A counter effect would be a higher sown acreage than earlier expected. We have upgraded our acreage estimates and now see the year-on-year increase in the upper end of the 5-6% span. Assuming average sugar yields per hectare, production might reach close to 17.5 million tons.

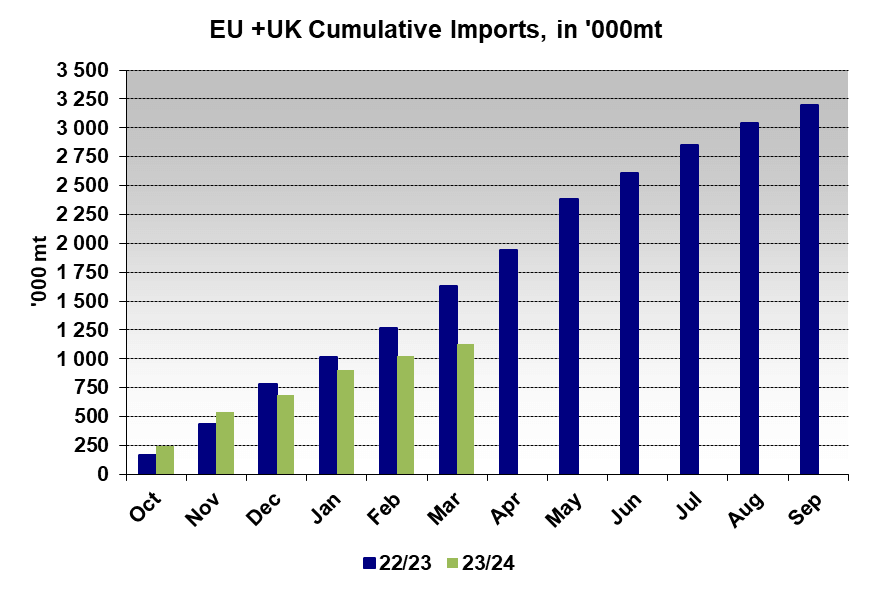

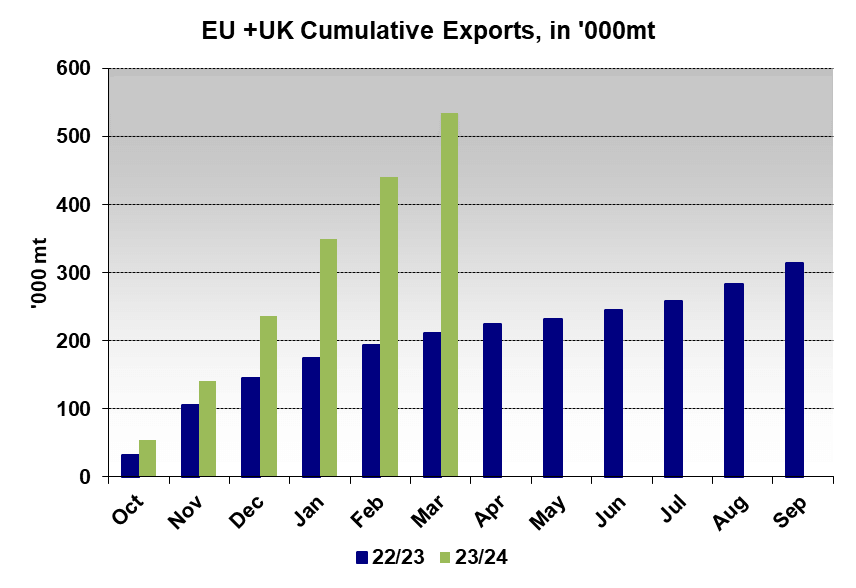

Given the increase in production and a slightly weakish demand, export is set to increase to around 1.4 million tons in the next SMY 2024/25. Cumulative export from EU/UK to third countries in the first six months of this Sugar Marketing Year was 535 thousand tons and with the need to empty storage before the start of the new campaign it is reasonable to believe that sugar will be shipped at a slightly higher pace in the last six months of the marketing year. Monthly import flows have come down by 2/3 since October and if the current pace is maintained until September, total imports will fall short of our current estimate of 1.9 million tons. The expectation for 2024/25 is a further reduced total import of 1.7 million tons with a downside potential due to the lack of economic incentives. Ending stock as of March was reported at 10.1 million tons. Although some 1.2 million tons higher year-on-year, we can see a closing gap between the years, and we expect that a negative trade flow in the coming months will close the gap entirely.

Exports of Ukrainian sugar to the EU have reached the trigger volume (262,600 tons) already during May for activating the safeguard clause. Exports of sugar to the EU will therefore be banned from 1 June 2024 until the end of 2024. Starting from Jan. 5, 2025, only 110,000 mt would be tariff-free, and once this quantity is reached, tariffs would be reintroduced.