12 November 2024

EU sugar market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during February this year. How did the fundamentals develop and what are the expectations after the beet sugar production campaign 2024 has started?

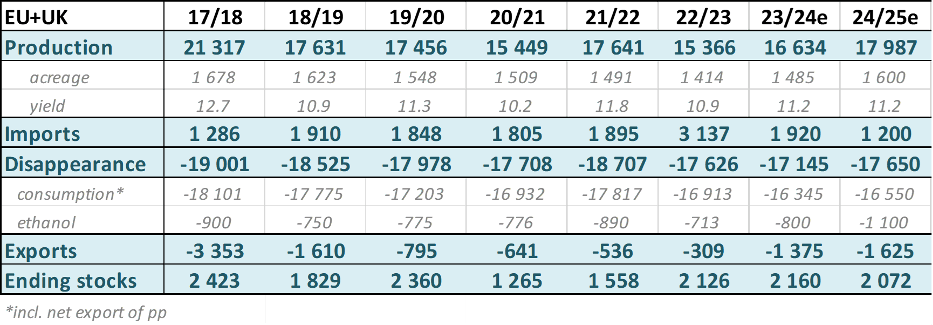

The campaign has reached full speed across the EU after a pretty early campaign start driven by the need to process a crop sown on an area grown on 1.6 kha (+7.7% year-on-year). There are in the meantime quite some mixed messages regarding the status of the beets. While the beet yield has shown a good development, the sugar content has not caught up as some may have expected. At the beginning of the campaign, the outlook on sugar production was strong but this has recently changed, and numbers are now corrected downwards. Our statistics currently show a projection of 17.9 million tons beet sugar production. This is still a good million ton increase year-on-year, however there is a real risk that numbers will be further corrected. The general wet conditions across the continent are raising concerns about beet quality as we enter the second phase of what will be a very long campaign with frost damage risk increasing after end of December. We reported about increasing risk of new diseases already last year. The significance of those Stolbur and SBR diseases is in the meantime continuously increasing, especially in southern Germany as well as in eastern Europe. They mainly impact the sugar content and in case of Stolbur also the storability of the beets.

European Sugar Balance as per EU Commission / Nordzucker own data:

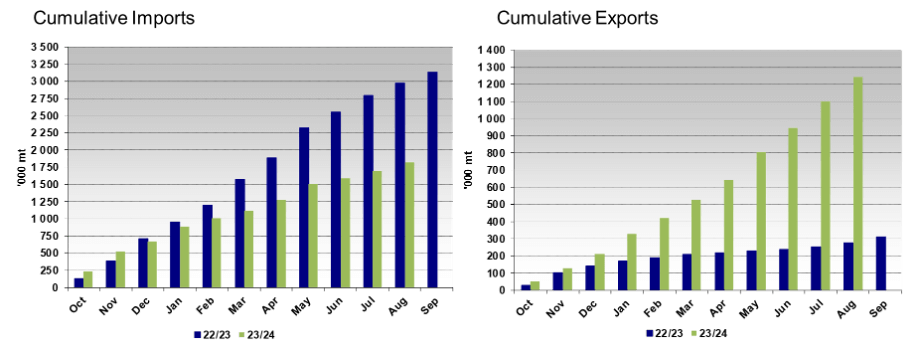

Reported stocks in EU27 continues to deteriorate faster than last year as exports continues at a high pace, supported by a healthy world market price. Imports on the other hand is rather limited for the same reason as domestic EU prices do not support refining activity, not even if raw sugar could be imported without import duty or preferential premium. On trade flows, we expect more of the same throughout the new sugar marketing year; export is set to reach approximately 1.6 million tons while imports will reach 1.2 million tons or even lower depending on the final production.

By end of October domestic prices have started to increase and have passed LDN#5 white sugar price. The revised production prospects, manageable stocks and stabilized domestic demand should incentivize further positive developments.