7. Juni 2021

EU sugar market update

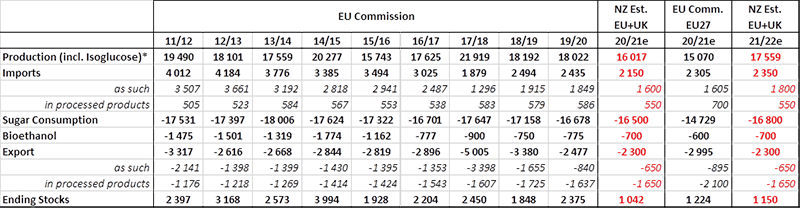

In this article, we will look into developments in the European sugar market since our latest newsletter sent out during February this year. How did the fundamentals develop and what are the expectations after sowing finalized for coming season? We need to speak about a currently very tight sugar balance and that Europe will continue to be a net importer also next year.

It has been a long period of restrictions and lockdowns influencing also sugar consumption from December last year until April / May 2021 across Europe. Now, the optimism is back, vaccination rates are improving and many countries are easing restrictions and are opening up boarders and welcome tourists. Sugar demand is rising significantly as Food & Beverage producers are filling the pipeline and demand in the Foodservice and Horeca channel is finally there.

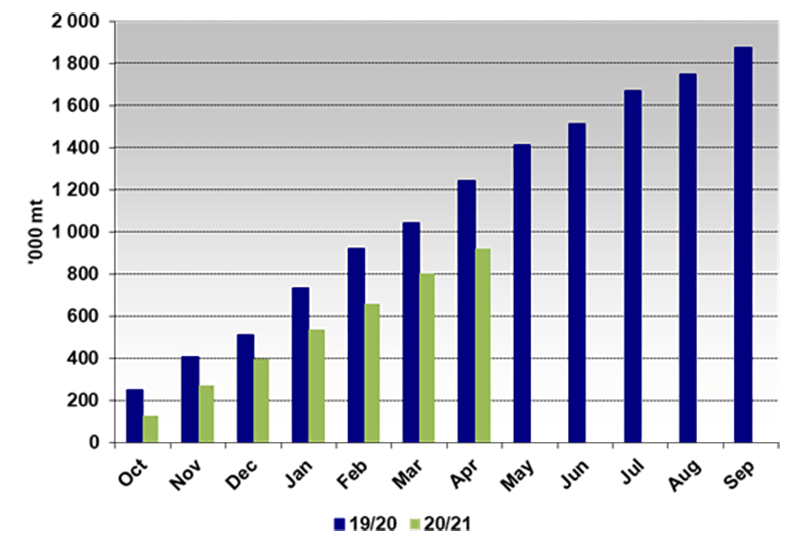

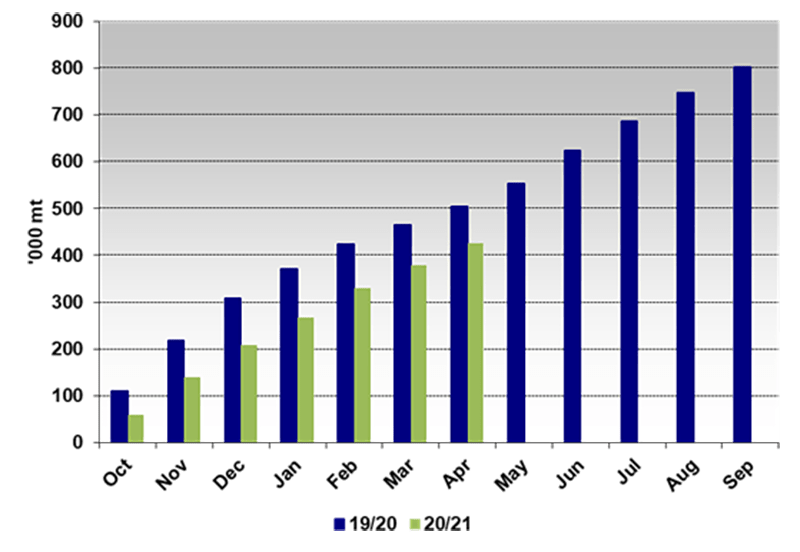

We think the market is undersupplied until start of new campaign; any availability depends on the need and readiness of market participants to increase imports and accept the level of import parity. By early May, less than 800 kto had arrived into the EU+UK, which is almost 300 kto less than last year at the same point in time.

The spot markets have meanwhile reacted and are trading at levels above 500 €/to DAP in deficit areas.

When looking into next year, we do think that the sugar production in the EU27 / UK will rebound following the disastrous yellow-virus impacted crop 20/21. However, despite good weather in May and an improved forecast for the near future, beets are to-date behind schedule in most countries. Rows are expected to close three weeks later than normal. It is therefore fair to say that the probability of above-average yield remains on the lower side but still too early to call the outcome of this crop. The last year dominating yellow virus impact should however not pose a larger threat this season, as a) the cold weather over the winter should have reduced aphid populations and b) derogations from the use of neonicotinoids in some countries should help agri yields to rebound.

However, the acreage under sugar beet is expected to decrease again by 1-3% and by this the 4th year in a row down to 1,470 tha. Returns for farmers are still poor at present (not to forget the recent price surge of relevant alternative crops like wheat and canola).

We foresee a sugar production of around 16.8 Mioto and with this production will still fall short of approximately one Million ton in comparison to consumption. Imports will be again required on significant scale to avoid that stocks fall below the critical level already seen this year.