11. Februar 2025

EU sugar market update

In this article, we will investigate developments in the European sugar market. How did the fundamentals develop and what are the expectations after the beet sugar production campaign 2024/25 is coming to an end?

We are on the home stretch at Nordzucker: in mid-February, the last beets will be processed in our plants in Germany (our other countries finished during January). This marks the end of an exceptionally long campaign. It was very different from the previous one, which was marked by heavy and persistent rainfall and flooding in many growing regions. The changing conditions of the most recent campaigns are symbolic of the diverse challenges that our industry and agriculture must overcome. We continue to operate in a volatile sugar market. Sugar prices in the EU are already showing signs of appreciation due to the expected reduction in the cultivation area next year. Time is of the essence when it comes to the other challenges which makes the forecast for next season even more complicated. Key words are climate change (including risk of drought) and the spread of plant diseases. The spread of new pests such as the glasswing cicada, which transmits diseases such as Stolbur and Syndrome Basses Richesses (SBR), threatens not only sugar beet, but also carrots and potatoes. We urgently need to work on solutions here after realizing visible effects in part of Southern Germany and Eastern Europe.

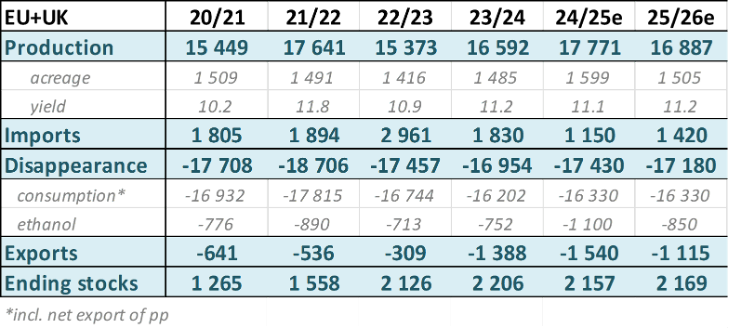

European-wide, the 2024/25 campaign is slowly coming overall to an end. The Dutch campaign ended on 21st of January with a final sugar yield at 12.2mt/ha – 10% down year-on-year and an indication of lower overall production despite higher acreage. France and Germany will continue the campaign into February, while the UK will carry on into March. A completely different situation in South-East Europe with countries like Croatia, Hungary, Slovakia but also neighboring countries like Serbia suffering strongly under above mentioned diseases and drought conditions / heat waves. Although production estimates have gradually been revised down since the start of the campaign, total production is still estimated to be the highest since 2017/18. We maintain our production estimate for EU+UK at 17.8 million tons, with a downside risk. Due to the high production this campaign, good stocks and a high export number, it is expected that total acreage reduction in EU+UK for next season will reach 6-8%, which would mean a decrease in sugar production in the range of +/- one million tons, given average yields.

European Sugar Balance as per EU Commission / Nordzucker own data:

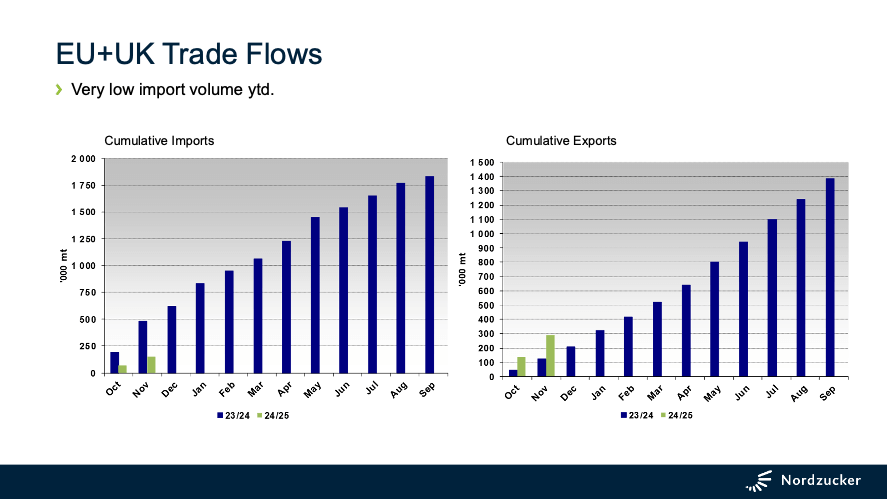

Official trade statistics show trade flows developing as expected with imports into EU+UK reaching only 154 thousand tons in the first two months of the current sugar marketing period (-68% year-on-year), while exports reached 288 thousand tons during the same period (+128% year-on-year). We expect a small uptick in imports during Q1 as the Ukrainian import quota opens up, while we expect strong exports to continue throughout Q1, followed by a slower Q2.

Last year in February the protests against the uncontrolled and distorting inflow of agricultural products from Ukraine were steadily increasing and resulting in reinforcing protection for sensitive EU agricultural products including sugar, which will expire by 5th June 2025. At the time of writing, the discussions on European level on the future design of the Association Agreement with the Ukraine are proceeding. Those discussions within the Commission are becoming increasingly political at the cabinet level. The negotiations between the Agriculture and Trade Commissioners will be crucial in determining the outcome in the upcoming days/weeks. We will keep you updated.